A reliable power source is essential for any business, whether you operate in construction, manufacturing, healthcare, or retail. Investing in a diesel motor generator ensures that your operations continue uninterrupted during power outages. However, the upfront cost of purchasing a generator for sale can be substantial, making financing a viable option for many businesses. In this guide, we’ll explore the various ways to finance a diesel generator in Canada, so you can make the best decision for your business.

1. Understanding Your Generator Needs

Before seeking financing options, assess your business’s power needs. Consider factors like:

- The required power output (kW or MW)

- Whether a Caterpillar generator company or Cummins generator Canada product best suits your needs

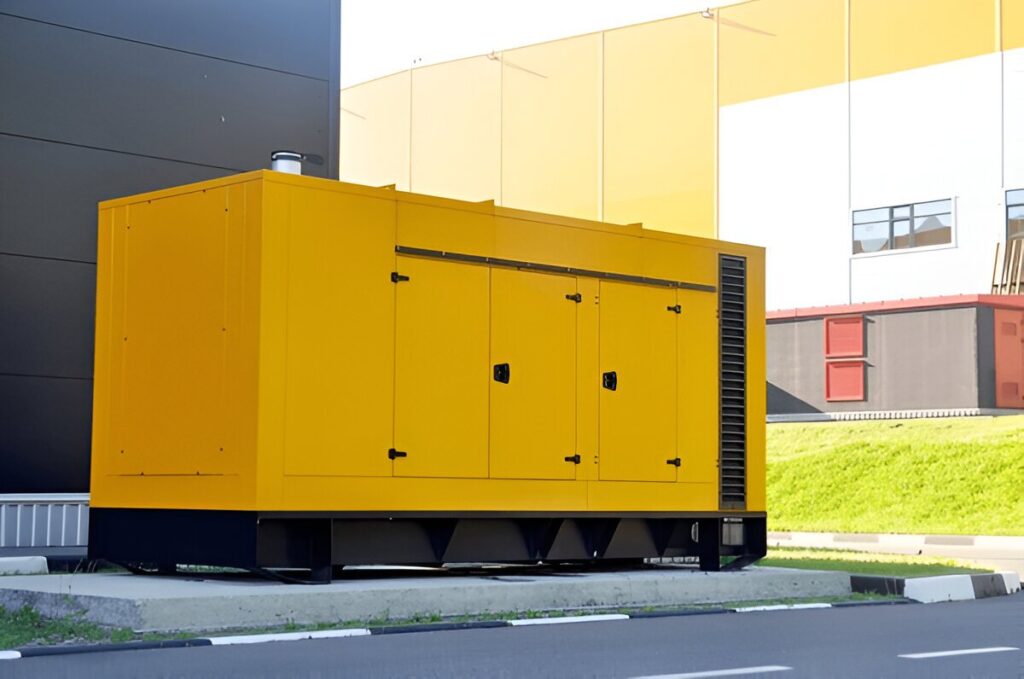

- The type of generator enclosure needed for protection and efficiency

- Whether a new or used generator for sale fits your budget

Understanding these factors will help you determine the total cost of your investment and the best financing approach.

2. Financing Options for Diesel Generators

A. Business Loans

Business loans are one of the most common ways to finance a diesel fueled generator. Banks and financial institutions offer both secured and unsecured loans to help businesses purchase equipment. Some key considerations include:

- Interest rates and repayment terms

- Collateral requirements

- Approval time and credit score requirements

B. Equipment Leasing

Instead of purchasing outright, leasing allows businesses to use a generator while making regular payments. Leasing benefits include:

- Lower initial investment

- Flexible upgrade options

- Potential tax benefits, as lease payments may be deductible

C. Government Grants and Incentives

The Canadian government offers various grants and tax incentives for businesses investing in energy-efficient or backup power solutions. Programs like the Canada Small Business Financing Program (CSBFP) can help ease the financial burden of acquiring a generator for sale.

D. Vendor Financing

Some Caterpillar generator company and Cummins generator Canada dealers offer in-house financing plans, allowing businesses to acquire a generator with structured payment options. This can be a convenient solution with competitive interest rates and flexible repayment terms.

E. Business Line of Credit

A business line of credit provides flexible funding that can be used for purchasing a diesel motor generator or other essential equipment. It allows you to borrow as needed and pay interest only on the amount used.

3. Factors to Consider When Choosing a Financing Option

When selecting a financing plan, consider:

- Total Cost of Ownership: Beyond the initial price, factor in maintenance, fuel costs, and generator enclosure expenses.

- Repayment Terms: Ensure monthly payments align with your business cash flow.

- Tax Benefits: Some financing options allow for tax deductions, reducing overall costs.

4. Finding the Right Generator for Your Business

When financing a generator, it’s crucial to choose the right model. Whether you need a Caterpillar generator company product, a Cummins generator Canada model, or a used generator for sale, BC Generators offers a wide range of high-quality options to suit your needs.

Explore our inventory of diesel fueled generators and financing options today by visiting BC Diesel Generators. Secure reliable power for your business without the financial strain of an upfront purchase.

By understanding financing options and selecting the right generator, you can ensure your business remains powered, no matter the circumstances. Contact us today to learn more about our available generator for sale options and financing solutions!